UPDATED: Business Risks in 2021: What You Need to Know

UPDATED on 13 July 2021

There is appalling looting taking place in South Africa as you read this article. We sympathise with businesses that have been affected. We want to assist in ensuring your livelihood is safeguarded. This is a form of unmitigated business risk that will take an emotional toll on retailers. We, therefore, urge shop owners to speak to a business consultancy that has access to independent financial advisers who can recommend comprehensive business insurance coverage. Please chat with one of our consultants today.

How secure is your website? Does it have an SSL certificate, advanced firewall and comprehensive anti-virus software? These are only three of the essential cyber protection tools required to mitigate cybersecurity risks to businesses.

According to an article published by BusinessTech, “The latest Allianz Risk Barometer for 2021 shows that, while South African businesses are concerned about interruptions brought about by the Covid-19 pandemic, cyber incidents and security issues remain the biggest risk to their operations.”

Cyber Incidents: Protect your business

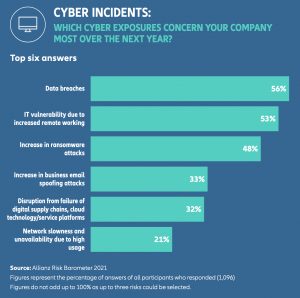

As you can see from the infographic below, 56% of companies reported that they are concerned about data breaches and information technology (IT) vulnerability caused by the massive increase in remote working due to the pandemic.

These are cybersecurity business risks that need stringent strategies that can be implemented now! Our consultants can recommend and implement crucial cybersecurity IT solutions for you. Failure to do so will impact the other types of business risk that are discussed below.

©Allianz Risk Barometer 2021

One of the traits of developing a successful business is having contingency plans for risks that you may face. Insufficient planning can lead to profit loss and even permanent closure. In this article, we’ll define and explain the different types of business risk. Here’s what you need to kno

What is business risk?

Business risks are factors that threaten and inhibit your business’s overall operation, which in turn prevents it from achieving its targets and financial goals. Numerous sources contribute to the risk; they may be internal, external or a combination of both, such as poorly managed policies and procedures and the overall state of the economic climate.

Business red flags

- Market risk

Market risk, also known as systematic risk, affects the whole performance of a business. Sources of market risk include recessions, changes in interest rates, political instability and natural disasters.

Amid the coronavirus pandemic, businesses in many sectors are struggling and may be looking for a cash injection from potential investors. If this is the case, it’s essential that you can prove effective incident-protection strategies are ready to be implemented; a lack of planning is a massive red flag and will deter investors quickly.

- Credit risk

Many start-ups and SMEs need to take out a business loan to fund start-up and necessary operational costs such as rent of office space, purchasing of material and equipment, set up of internet, and other IT solutions. As a business entity, you are obligated to pay the lending institution (e.g. a bank) an agreed-upon amount every month. This means that you must have sufficient cash flow to budget for this expense. If you cannot pay (default) on the loan, compound interest will accumulate, increasing the amount you owe.

Credit risk is calculated according to the five Cs: credit history, capacity to repay, capital, the loan’s conditions, and associated collateral. If your business is considered to be a high credit risk, it’s possible that you won’t qualify for a loan in the future, or you may have to use a subprime lender that charges inflated interest rates. You must be able to manage credit correctly. This means having enough cash flow to pay creditors. The consequences of defaulting can be dire and liquidation, business rescue.

- Liquidity risk

Liquidity is your business’s ability to repay its debts without suffering significant losses. Potential investors will utilise liquidity measurement ratios when analysing the level of risk of a business – the result will determine whether an investment is worthwhile. They’ll usually compare your business’s liquid assets and short-term liabilities. Liquid assets include but are not limited to cash or cash-equivalent assets; these comprise stocks, bonds, and mutual funds. They are considered cash-equivalent assets because they generally won’t lose value when sold.

Liabilities are usually a sum of money that a company owes to creditors such as loans, accounts payable and other accrued expenses. It’s critical to understand liabilities because they are used to finance the operations of the business.

Businesses will sort their liabilities into two categories: current and long-term. Current liabilities are classed as debts payable within one year; whereas, long-term liabilities are debts payable over a longer term. An investor will ideally want to see that a business can pay current liabilities in cash and long-term liabilities paid with assets accumulated from future earnings.

- Operational risk

Operational risk is viewed as any hazards or ambiguities that can hinder the daily activities of a business. This can be caused by internal factors such as poor policies and procedures. An example may be poor maintenance of equipment and IT systems. Something as simple as not checking the stability of your internet connection can cause havoc if it’s not working correctly. There are also external influences, which in South Africa can include load shedding of electricity and economic events that contribute to market risk.

- Cash flow

Cash flow is the net amount of cash (and cash-equivalent liquid assets) transferred in – and out – of a business. A business’s ability to generate positive cash flows creates value, which is a factor that will encourage investors to put their money into the business.

There are three forms of cash flow:

- Operating

- Investing

- Financing

Operating cash flow is all money that is generated from the business’s daily activities.

Investing cash flow includes but is not limited to purchasing capital assets and other investments.

Prospective investors will also be looking at the business’s ability to maximise free cash flow (FCF), which is the cash that a business can produce after it has accounted for money needed to sustain daily operation and maintain capital assets. Essentially, free cash flow is a measure of profitability that excludes any non-cash expenses but includes spending on equipment, assets as well as any changes in working capital (which is the difference between your current assets and current liabilities.) Financing cash flow comprises all money gained from issuing debt, equity, and all payments made by the business.

Key takeaways

The different types of business risks include.

Market risk: Sources of market risk include recessions, changes in interest rates, political instability and natural disasters.

Credit risk: Credit risk is calculated according to the five Cs: credit history, capacity to repay, capital, the loan’s conditions, and associated collateral.

Liquidity risk: Liquidity is your business’s ability to repay its debts without suffering significant losses. Potential investors will utilise liquidity measurement ratios when analysing the level of risk of a business

Operational risk: Operational risk is viewed as any hazards or ambiguities that can hinder the daily activities of a business. This can be caused by internal factors such as poor policies and procedures.

Cash flow: Cash flow is the net amount of cash (and cash-equivalent liquid assets) transferred in – and out – of a business.

Steps needed to create a risk management plan

All businesses need a risk management plan. Here are the primary steps that you need to take.

- Identifying risks

Find out the risks that are most likely to occur. It would be best if you also determined which risks will cause significant disruption and minor disruption.

- Analysing risks

Once these risks have been identified, financial planning specialists need to be analysed who can help develop strategies that will minimise or eliminate the risks.

- Planning for risk response

A specific contingency plan needs to be developed according to your business’s size and type (sector-specific) because certain risks will be more prevalent than others. Therefore, the plan needs to be customised to address those risks effectively.

- Monitoring risks

All the types of risk that have been identified should be continually monitored to ensure your business can run as smoothly as possible.

Key takeaways

Your risk management plan must include the following steps.

- Identifying risks

- Analysing risks

- Planning for risk response

- Monitoring risks

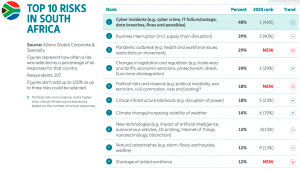

These are 10 of the risks facing South Africa in 2021.

©Allianz Global Corporate & Specialty

We are a world-class business consultancy with in-house independent financial advisers. They understand your needs and wants and give you the peace of mind that your business is strategically prepared for all relevant risk factors. You can focus on building your brand and driving revenue growth to achieve your financial goals.